QIMA 2021 Q4 Barometer

Q4 2021 Barometer: Can South Asia Sourcing Save the Holiday Season from Supply Chain Chaos?

Ongoing Supply Chain Snarls Threaten Supply of Consumer Goods in the Run-Up to Holiday Season

Between the ongoing global logistics logjam, a new wave of COVID-19 related lockdowns in Asia and a manufacturing stall in China due to energy shortages, global sourcing displays ominous signs for the upcoming holiday shopping season, proving that brand and shopper fears are far from unfounded.

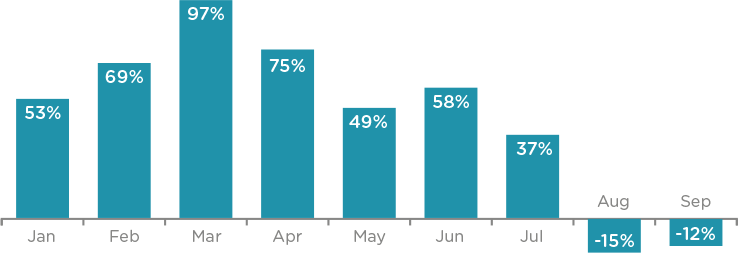

In Asia, outside of China, QIMA has observed a spike in inspections delays and postponements in Q3 2021: in September 2021, the percentage of postponed orders doubled compared to May and June levels, evidencing the difficulty brands and their suppliers face in maintaining orders’ schedules. This trend goes as far back as July and has coincided with the worsening shipping crisis and the lockdowns in many parts of Southeast Asia triggered by a surge in cases of the COVID-19 Delta variant.

Vietnam Lockdowns Stifle Sourcing Good Fortune

Vietnam, previously a winner of the US-China trade war and a success story on virus containment, has suffered a dramatic downhill slide in Q3 2021, with COVID-19 Delta cases surging and lockdowns putting severe constraints on business activity.

QIMA data on inspection and audit volumes in Vietnam shows a contraction in every month of Q3, starting with -5.5% YoY in July, then plummeting to -45% YoY and -52% YoY in August and September respectively. Compared to pre-pandemic 2019, inspection and audit demand in Vietnam contracted -36.5% in Q3 2021: in a country where garment and footwear make up majority of the exports, over one third of apparel factories temporarily closed in recent weeks.

While not the only country in Southeast Asia to be suffering from the Delta variant, Vietnam sourcing has been affected more than most, as buyers shifted orders to neighboring countries. By comparison, Cambodia saw Q3 inspection and audit demand spike +34% compared to 2019, with high vaccination rates cited as one of the key factors for its current sourcing success.

Fig. 1. Vietnam inspection & audit volumes, 2021 vs. 2019

Attempted Reversal of Sourcing Back to China Proves Less Than Ideal

With Southeast Asia’s sourcing markets buffeted by ongoing disruptions, there is plenty to indicate that Western buyers may be reversing their supply chain shifts of recent years by returning to China. While the end-of-quarter data on inspection and audit demand backs up this trend somewhat (+5.5% YoY expansion in China inspections ordered by US-based clients and +4% YoY, by EU-based ones), a look at more recent developments points to this strategy being potentially untenable.

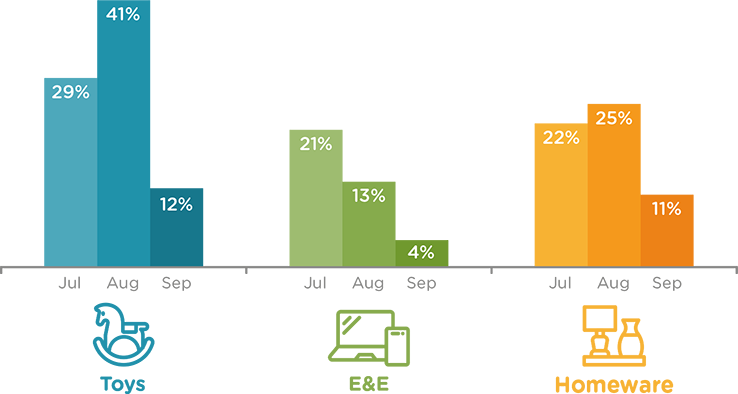

During September, China’s power cuts resulting from energy shortages stalled the pace of manufacturing, and QIMA data reflects a notable slowdown of China sourcing across multiple product categories, including goods in especially high demand for the holidays, such as electronics, toys and homewares. A look at YoY dynamic throughout Q3 2021 reveals the slowdown towards the end of the quarter, with E&E inspection and audit demand growth plummeting from +21% YoY in July to single digits in September, and similar drops in Toy and Homeware inspections.

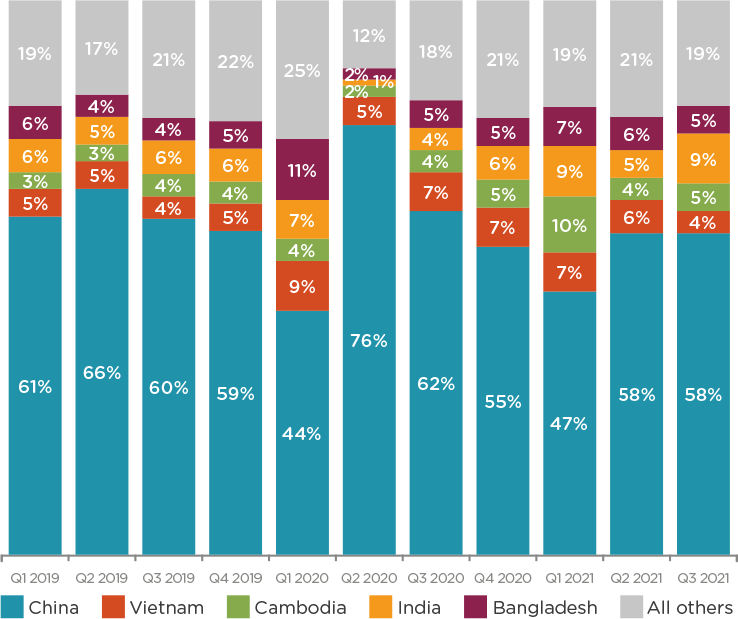

Given these struggles, it should come as no surprise that despite the temporary turnaround, China’s relative share in the sourcing portfolios of US and European brands remains lower than in 2019, suggesting that even given a renewed interest in China, brands continue to diversify their buying between other high-priority geographies.

Fig. 2. China Q3 volumes, YoY

Seeking to Offset Manufacturing Capacity Loss, Western Brands Flock to South Asia

With the double whammy of lockdowns in Southeast Asia and China’s manufacturing slowdown, buyers have been hard pressed to seek alternative production capacities in Q3 2021. South Asia’s sourcing hubs have proven vital in their search.

After being hit hard by COVID-19 earlier in the year, India saw inspection and audit volumes surge +67% in Q3 2021 compared to the pre-pandemic period (and +78% QoQ). Demand was particularly strong among US-based buyers, with September demand more than doubling from 2019 levels. Meanwhile, Bangladesh also saw demand for inspections and audits expand in Q3 2021, with orders from US-based brands up +88% in August and +108% in September, compared to the corresponding month of 2019.

Notably, while South Asia is a time-tested sourcing hub for Textiles and Apparel, demand for its manufacturing capacities was not limited to this product category: QIMA data for Q3 2021 shows growth across a wide variety of consumer products, including homewares and gardenware, food containers and toys.

As we rapidly approach a peak holiday season hindered by unprecedented supply chain chaos, it will be interesting to see if India and Bangladesh can continue to pick up the sourcing shortfall to meet growing demand as Western economies emerge from retail hibernation.

Fig. 3. Top 5 inspection & audit regions (US & EU buyers)

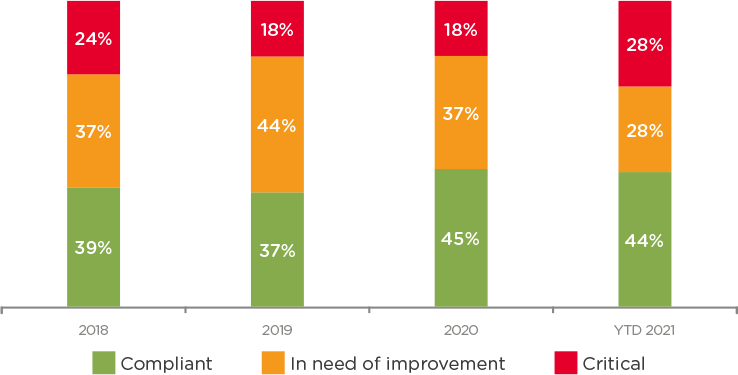

Increased Percentage of Factories with Critical Ethical Violations Underscores Need for Regular Follow-Up

After six consecutive months of deterioration in ethical compliance, data gathered by QIMA auditors shows a +5% uptick in factory ethical scores in Q3 2021 compared to the previous quarter. However, it is too early to be optimistic, as long-term data shows an increase in the share of “Red” (critically non-compliant) factories, suggesting that that factories previously assessed as “in need of improvement” were more likely to see ethical compliance slip further in 2021. This starkly underscores the need for regular follow-up after initial factory assessment, in order to ensure that necessary improvements are implemented and maintained continuously.

Fig. 4. Evolution of factory ethical rankings, 2018-2021

All signs point to supply chain disruptions ruining the fun this holiday season, with consumers already being warned to get started on their holiday shopping early or risk missing out on products entirely. We don’t see this pressure alleviating any time soon as key sourcing regions China and Vietnam continue to be battered by circumstances out of their control, and question marks form over which brands will be agile enough with their supply chain management to minimize holiday losses.

Press Contact

Email: press@qima.com